WHO WE ARE?

EGH is a globally driven company that is controlled, operated, managed, and directed by some of the world’s top iconic individuals—self-made millionaire and billionaire entrepreneurs—not just from the Middle East, but also from around the world.

WHAT DO WE DO?

The mission of “EGH” is to help almost any company succeed. Whether it’s a startup or an existing business that isn’t growing fast enough, EGH provides the tools and expertise to accelerate progress. EGH is an organization that focuses exclusively on acquiring, consulting, and preparing companies for major acquisitions or for going public (IPO). EGH achieves this by becoming directly involved in operations—structuring processes, raising funds, and enabling global expansion. EGH also specializes in guiding companies to go public, whether through a traditional IPO, a reverse merger, or a direct listing.

HOW DO WE DOIT?

The EGH team carefully evaluates every company to determine the best possible options as a consulting firm.

The EGH operating team—including the executive committee and board of directors—consists of individuals who are 100% committed and rated A+++ for professionalism, accuracy, intelligence, and involvement in global iconic ventures.

If Emerald Global Holdings LLC chooses to work with you—or allows you into their presence—it means you are truly blessed, both as an individual and as a company. You are sincerely the chosen one.

As the Chairman, Prince Fred, says:

“Ask me for money? You’ll get advice.

Ask me for advice? You’ll get money—twice!”

Types of Registered Offerings

What are the differences in an IPO, a SPAC, and a direct listing?

Many mature companies who have raised capital using exempt offerings in the private markets elect to “go public,” such as through a registered offering, either to raise additional capital, in response to investor calls for liquidity, or both. Companies have multiple pathways to becoming a public company under current securities laws, three of which are outlined below. While alternative pathways to IPOs, including SPACs and direct listings, have become popular in recent years, many factors play into which pathway a company chooses.

How special purpose acquisition companies (SPACs) work

What is a SPAC?

Special purpose acquisition companies (SPACs) have become a preferred

way for many experienced management teams and sponsors to take

companies public. A SPAC raises capital through an initial public offering

(IPO) for the purpose of acquiring an existing operating company.

Subsequently, an operating company can merge with (or be acquired by)

the publicly traded SPAC and become a listed company in lieu of executing

its own IPO.

This approach offers several distinct advantages over a traditional IPO,

such as providing companies access to capital, even when market volatility

and other conditions limit liquidity. SPACs could also potentially lower

transaction fees as well as expedite the timeline to become a public

company.

However, the merger of a SPAC with a target company presents several

challenges, including having to meet an accelerated public company

readiness timeline as well as complex accounting and financial

reporting/registration requirements that may differ based upon the lifecycle

of the SPAC involved. The target company's management team will need

to focus on being ready to operate as a public company within three to five

months of signing a letter of intent.

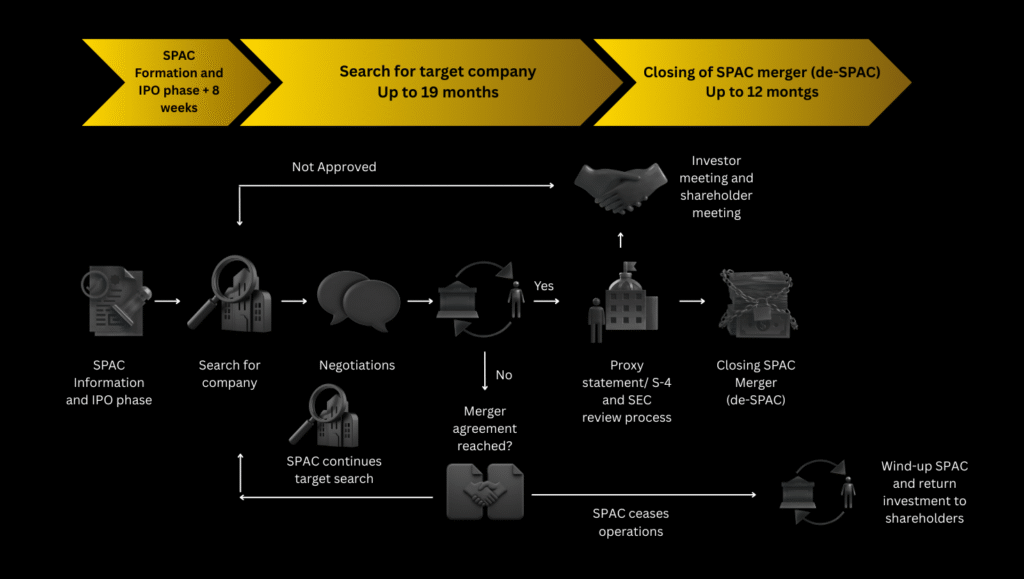

Typical SPAC timeline

SPAC life cycle*

Investor meeting &

shareholder meeting

SPAC information & IPO phase

Search for company

Negotiations

Yes

Proxy statement/ S-4 & SEC review process

Closing SPAC Merger (de-SPAC)

Merger agreement reached?

Wind-up SPAC & return investment to shareholders

A SPAC’s IPO is typically based on an investment thesis focused on a sector and geography, such as the intent to acquire a technology company in North America, or a sponsor’s experience and background. Following

the IPO, proceeds are placed into a trust account and the SPAC typically has 18-24 months to identify and complete a merger with a targetcompany, sometimes referred to as de-SPACing. If the SPAC does not complete a merger within that time frame, the SPAC liquidates and the IPО proceeds are returned to the public shareholders.

Once a target company is identified and a merger is announced, the SPAC’s public shareholders may alternatively vote against the transaction

and elect to redeem their shares. If the SPAC requires additional funds to complete a merger, the SPAC may issue debt or issue additional shares,

such as a private investment in public equity (PIPE) deal.

Here's how a SPAC generally works:

Special Purpose Acquisition Company, is a publicly traded company formedsolely for the purpose of acquiring or merging with an existing private company, thereby taking that company public. Think of it as a "blank check" company because it has no business operations of its own when it's initially formed

Sponsors form the SPAC:

A team of investors or experienced executives (the sponsors) create the SPAC with the goal of finding a promising private company to acquire

SPAC goes public:

Search for a target:

Acquisition and going public:

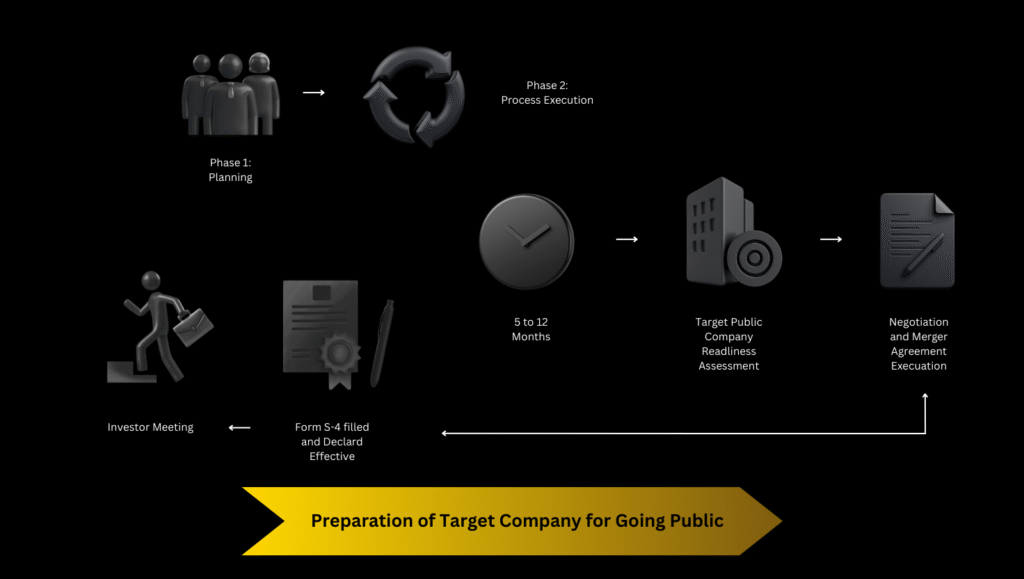

Overview of going public using a SPac

Phase 1: Planning

Phase 2: Process Execution

5 to 12 Months

Target Public Company Readliness Assessment

Negotiation & Merger Agreement Execuation

Form S-4 filled & Declared Effective

Investor Meeting

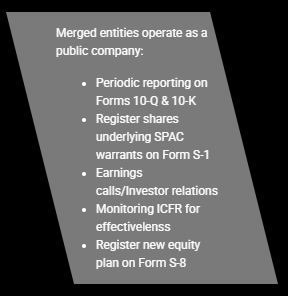

Merged entities operate as a public company:

- Periodic reporting on Forms 10-Q & 10-K

- Register shares underlying SPAC warrants on Form S-1

- Earnings calls/Investor relations

- Monitoring ICFR for effectivelenss

- Register new equity plan on Form S-8

Merged entities operate as a public company:

- Periodic reporting on Forms 10-Q & 10-K

- Register shares underlying SPAC warrants on Form S-1

- Earnings calls/Investor relations

- Monitoring ICFR for effectivelenss

- Register new equity plan on Form S-8

US M&A market at a giance

Accounting and reporting considerations

Public company readiness

Project management

Tax structuring

SEC reporting accommodations

Financial statements

РСАОВ audits

Accounting acquirer

Pro formas

MD&A

Discover the Emirates Global Holdings LLC

SPACs continue to gain popularity as a potential liquidity option for many companies. The SPAC merger process with a target company may be completed in as little as three to four months, which is substantially shorter than a typical traditional IPO timeline. Accordingly, a target company must accelerate public company readiness well in advance of any SPAC merger. Further, given the compressed timeline of a SPAC merger, project management is essential in order to reduce execution costs, increase project efficiencies, and provide working group participants with enhanced accountability and transparencу.

To create a clear path forward, you need the confidence that comes from working with a team of straight-talking advisors and actionable insights from a team of dedicated professionals. Find out how we can guide you through each step of the readiness assessment process and beyond.

How does a SPAC work for dummies?

A SPAC floats an IPO to raise the required capital to complete an

acquisition of a private company. The capital is sourced from retail

and institutional investors, and 100% of the money raised in the IPO is held in a trust account.

Who makes money in a SPAC*?

Typically, SPAC sponsors receive roughly 20% of the common equity in the SPAC and 3% to 5% of IPO proceeds. A SPAC can purchase one or more companies, and the managers of a SPAC typically earn a percentage of the value of a potential deal (commonly around 5%).